Being new on Main Street, there was a lot to learn for me. Having worked for the Boy Scouts for the previous eight years, I had honed my skills in event management, budgeting, communications and volunteer recruitment. However, there is a lot more to do on Main Street. Looking back, I don’t believe anyone can be fully prepared for a job as a Main Street Executive Director unless you’ve been there before. In addition to the things listed above, you’ve got to be knowledgeable about Economic Development, design, retail promotion, and many other key elements to downtown revitalization.

One of the areas that I had to learn was property development. Our Community (Quincy, IL) has a large downtown with well over 500 properties and a lot of amazing architecture, so I had to get up to speed on this pretty quickly. When I started on Main Street all I knew about property development was that it was important and it took money. I was extremely fortunate to have a board member who owned several properties in the district and knows the ins and outs better than anyone I’ve ever known. He was kind enough to teach me the basics (and maybe a bit more) so that I could help other property developers make sound decisions.

At the time I was taken aback at his generosity, seemingly working against his own self-interest to get other property owners building market rate apartments and developing properties that would compete against his own. However, what may have seemed like self-sabotage couldn’t have been further from the truth. This owner realized that he cannot develop every property downtown, and that his properties would increase in value and desirability when the downtown was a strong and thriving as possible…so helping new developers was really self-preservation.

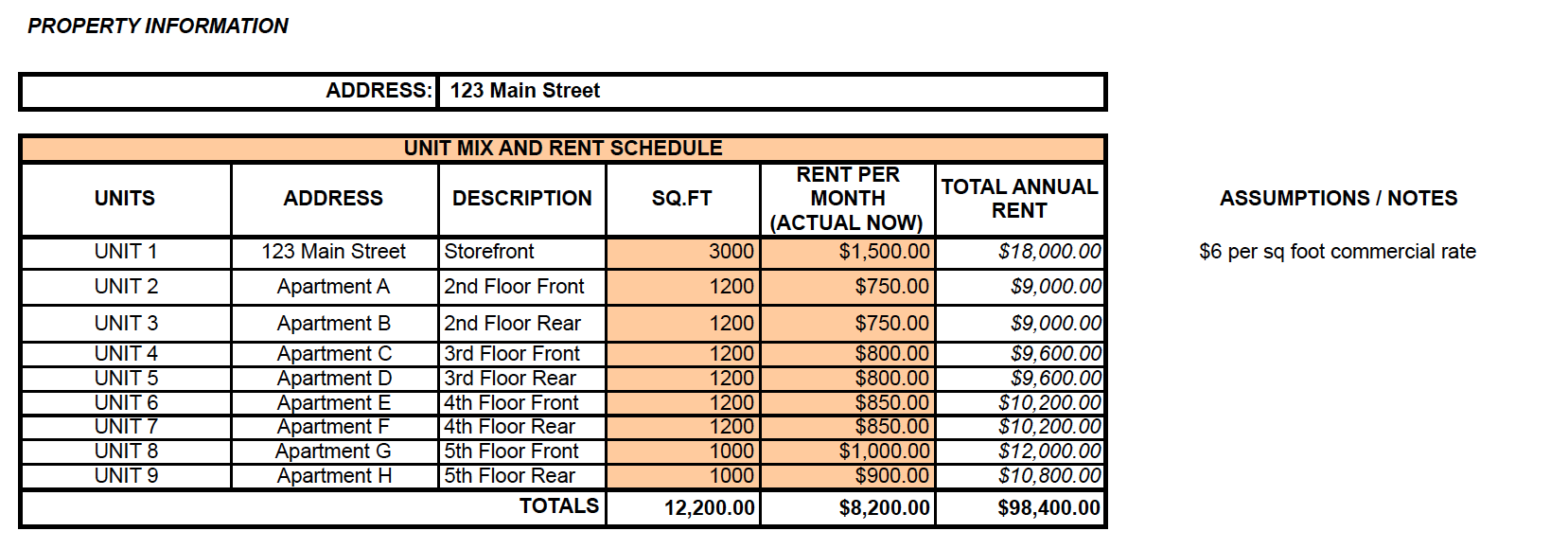

One of the more valuable tools that this property owner shared with me was a property pro-forma. This document really helped us walk property owners, especially new prospective property owners through the financing of the deal to make sure it was a good investment for them. So, let’s walk through it.

The first section we cover is the income section. Here, you list every unit within the building, the square footage, and the monthly and annual rent. Common areas that do not generate rent are not included in the square footage.

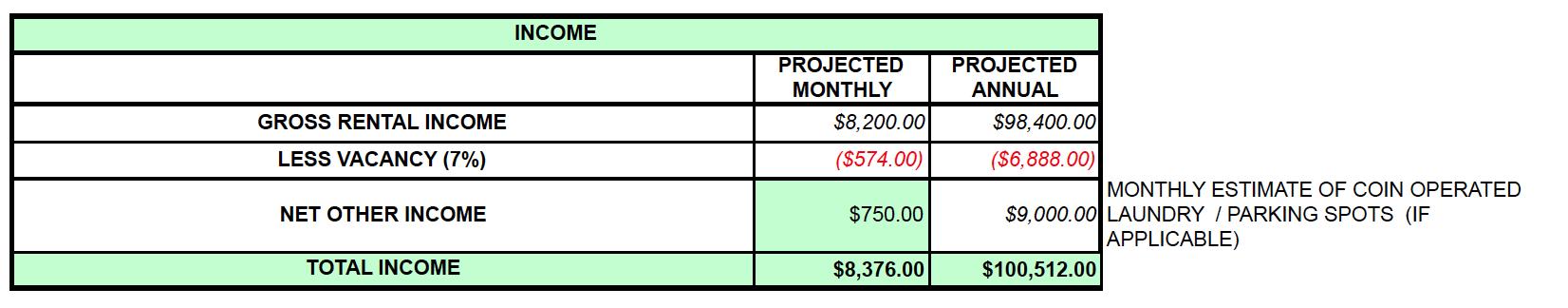

The second section of the income shows the Gross rental income, and also accounts for vacancy. This is another important step that can often be overlooked. While we used a 7% vacancy for our community, your rate may vary…though I would caution you not to dip too low. Even in a booming market, you will need to account for vacancy for time between tenants while cleaning/updating a unit and getting a new tenant in.

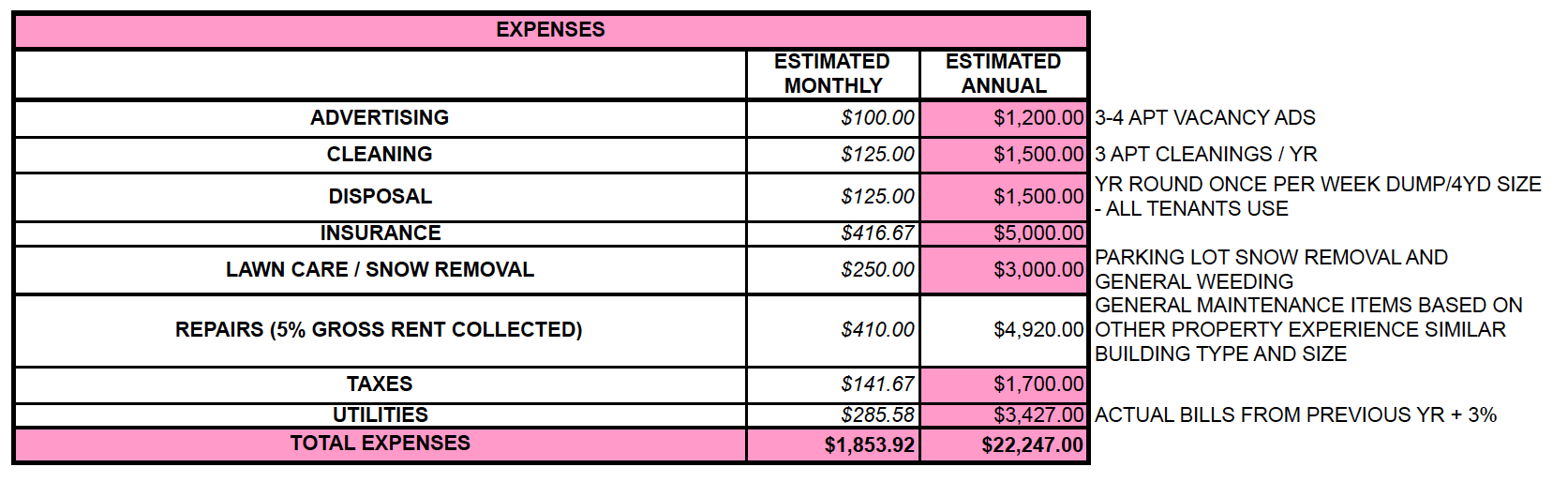

This covers all the expenses for the property owner. Each unit will usually pay their own power, internet, etc. The property owner usually covers the water, and there are expenses for things such as when a vacancy occurs a property owner will need to transfer the account to themselves to keep power on, and so on. Budgeting for repairs, cleaning, insurance, taxes and even advertising to ensure units are rented is important. Some of these are often overlooked and can be costly to a property owner trying to make the ends meet.

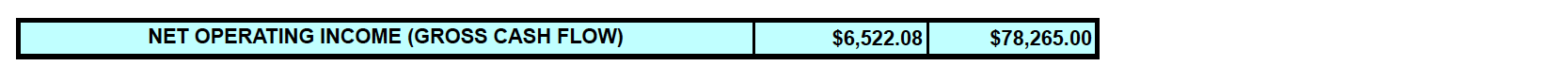

Combing the Income and Expense gives us the Net Operating Income (NOI):

Unless you are self-financing, the next portion of the pro forma is very important

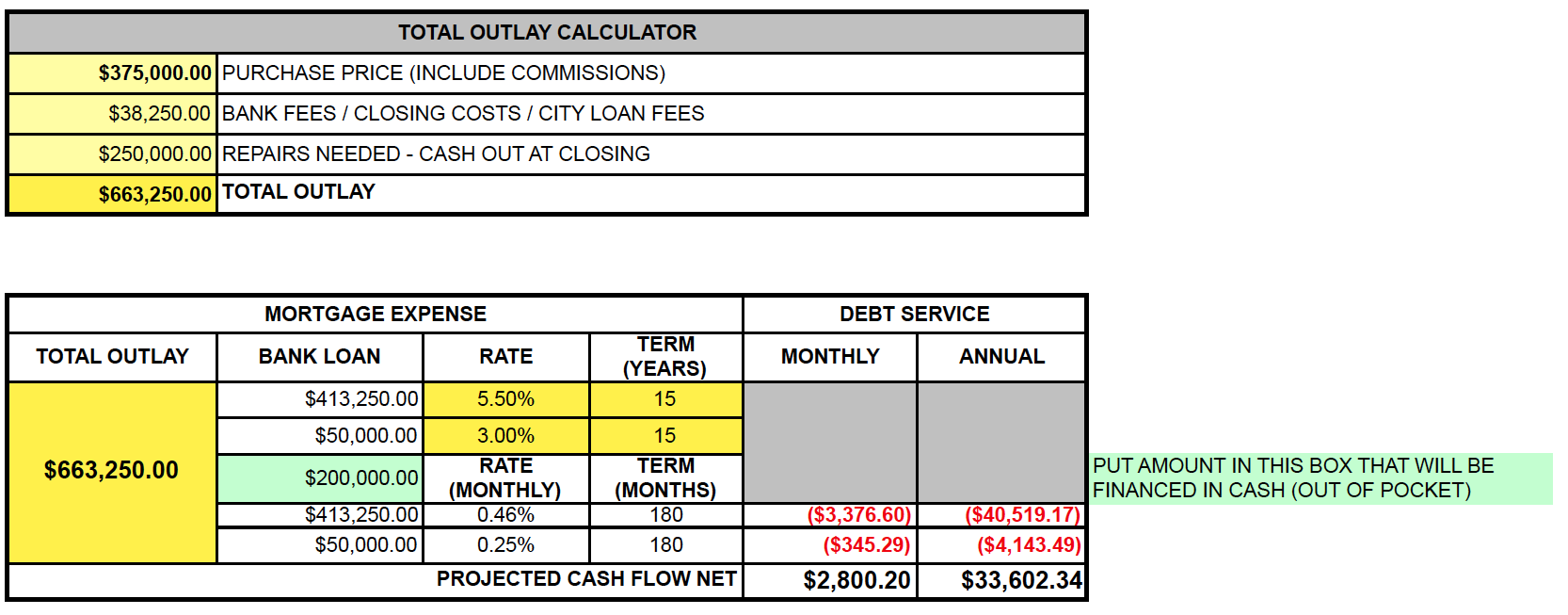

Once you input the purchase price (can be blank if you are only doing updates to a building you already own), bank fees and repair costs you’ll get your total outlay. The second section deals with mortgages. You might ask about the multiple bank loans. While most people aren’t financing the project in multiple places, there are likely various programs that a municipality or financial institution has that will help lower the interest rate (things like grants, rental rehab programs, etc). For each of these, you can input the amount, rate, and terms, which will give you a total debt service for the project. The bottom line also tells you your projected NET cash flow.

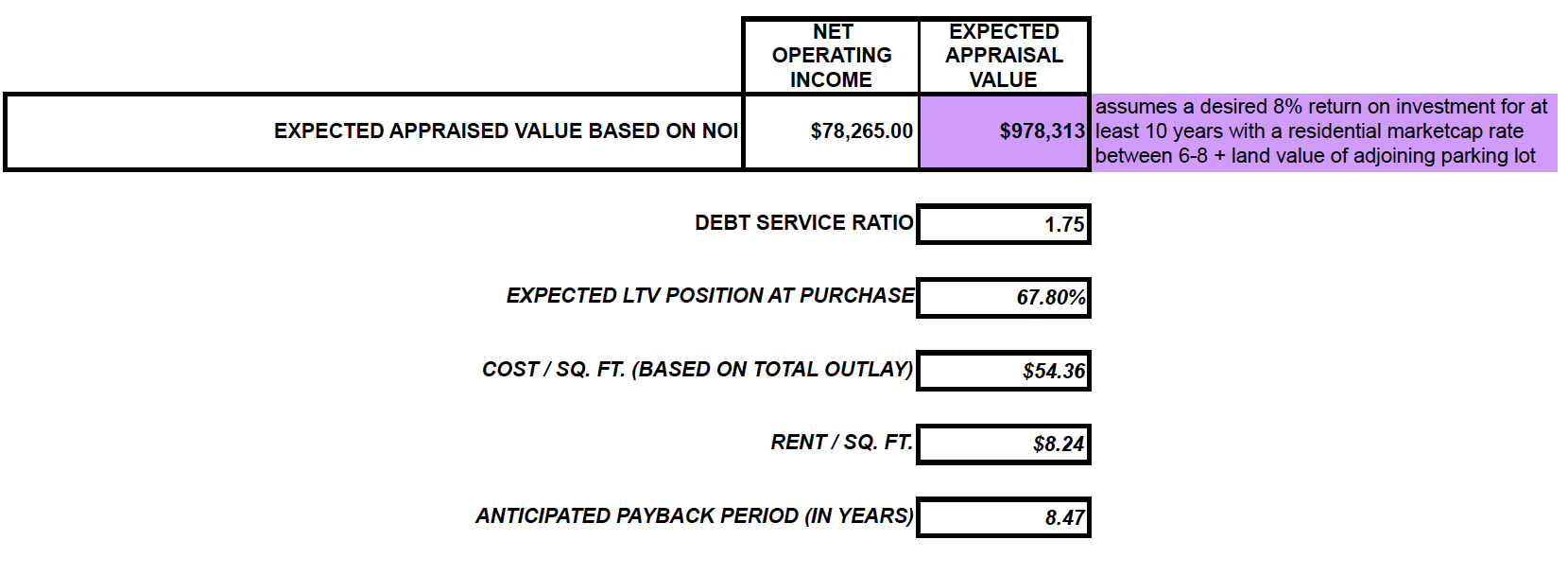

Now that we have included all the information, we need to evaluate whether or not this is a good investment. The first line (highlighted in purple) gives the expected appraised value based on our Net operating income from earlier, over a period of 10 years.

The debt service ratio is something lenders and commercial property owners are keenly aware of. The Debt Service ratio is a measure of the cash flow available to pay current debt obligations. The closer the number gets to 1:1 (or below), the riskier the investment.

The LTV (Loan to Value) ratio represents the amount of the project that is being borrowed. The higher the percentage, the riskier the project for the financing institution.

Cost per square foot and rent per square foot (remember to calculate rent for the year by square feet) are fairly self-explanatory. Our last column tells us how long it should take to payback the project, which is separate from the bank loan.

Looking at each property in these terms will help a property owner determine if this is a project that they can afford that will pay dividends for them in the future. I have personally used this form with many property owners, some of whom discovered that they weren’t in a position to make a project viable. This tool can be a valuable resource for any downtown director to walk new property owners through some of the ins and outs to make sure they’re ready to invest in your downtown. If you’d like to get a free copy of the pro forma, simply fill out our form on the right to have it emailed to you today!